Interesting issues in the ed finance/property tax in the last two weeks.

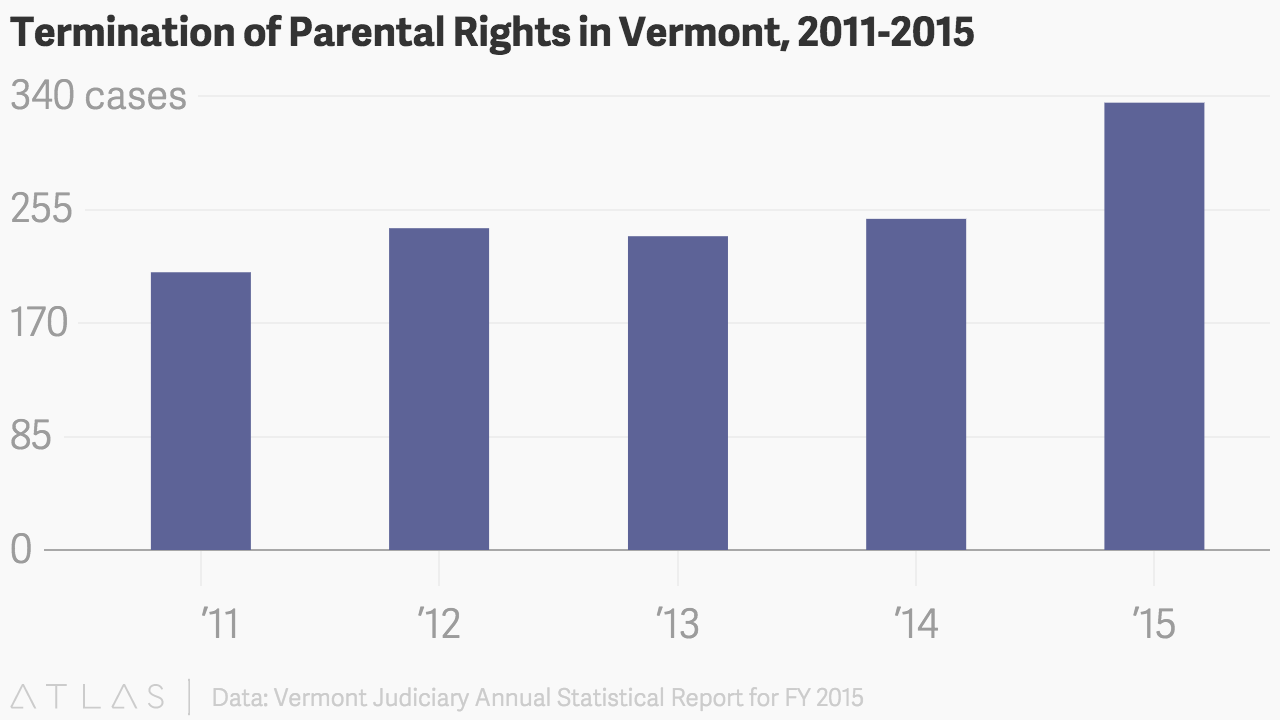

First there is a growing need for funding for state placed students (students having to live in foster families) who are coming into the public school system with increased trauma and need – some of which is being driven by the opioid epidemic. The state of Vermont is tasked with paying all costs for state placed students – and these costs were not adequately budgeted for last year or this year. In early May we are looking at about a 4 million dollar gap in the education fund.

Secondly, the state is under EPA mandates to address phosphorus pollution. Vermont Treasurer Beth Pearce has previously estimated that the state needs to raise $25 million a year to meet federal clean water requirements. The funding for this effort has been elusive with the Governor’s proposal to pay for it with Estate Tax and Property Transfer Tax and a senate parcel fee tax having already been rejected. The House Ways and Means Committee has settled on a solution which would raise a new tax off of market place facilitators like Amazon, veterinary supplies and cloud computing. In addition, the Committee is recommending reducing the 25% of meals and rooms tax which flows to the education fund to 21%. The effect of all of this will be to open up a $600,000 hole in the education fund – on top of the 4 million dollar hole created by increasing costs associate with state placed students. Anytime there is a shortfall in the education fund – it either has to be filled with cuts, which are incredibly difficult after budgets have passed, one time funds which are in short supply, or by increasing property taxes.

Making all of this even more interesting is the fact that we changed the education fund structure last year, and so now there is no longer a general fund transfer to the education fund to offset what is not raised by property taxes. Rather, all of the sales tax and 25% of the Meals and rooms tax are now supposed to be dedicated to the fund. This was thought to be easier for voters to understand then the calculations regarding the general fund transfer and also a secure funding stream. In addition, almost all residential taxpayers are now paying based on income.

What we are seeing emerging is that new programs that need new funds may have new types of taxes proposed to pay for them. If these are sales taxes, or other taxes which we have dedicated to the education fund, the situation will actually be more confusing for voters, in addition to raising the property taxes of most of our business and non residential property taxpayers.

For this reason I am contemplating an amendment to the S.96 clean water bill which will put a gate around the funding for the education fund and draw new program funds from new sources. We have seen too many instances of utilizing the education fund to pay for non education costs which drive up property taxes. If we are see reduced spending through district consolidations or healthcare savings, it will be tempting to spend those funds rather then return them to the property tax payers.