Good evening Friends and Neighbors

The photo above was taken on my drive up to Montpelier Wednesday for a Legislative Briefing before sunrise, in Dummerston.

Tomorrow, Saturday, December 6, I will hold office hours at the Dover Free Library from 11 AM to 12 PM. I encourage you to stop in.

This newsletter includes a short summary of the December 1 letter and the Fiscal Briefing Legislators received. I have also included links to reports on energy affordability and climate impacts on rural communities that I have been reviewing.

Thank you for staying engaged!

December 1 Letter

This week the Commissioner of Taxes sent the statutory December 1 education tax forecast to legislative leadership. The letter confirms an expected 12 percent average increase in education property taxes next year. It relies on long term enrollment decline and rising systemwide costs to explain that trajectory. Over the past twenty years education spending has increased by more than 900 million dollars while the state is educating about sixteen percent fewer students.

School budgets themselves are projected to rise by about 5 percent. The remaining increase are caused by state level decisions and investments. The letter does not detail state level education spending decisions that have and are contributing to property tax projected increases like last year’s 118 million dollar statewide buy down and other state-level appropriations like Dual Enrollment and Post Secondary investments.

On Wednesday’s pre-session education finance briefing to the Legislature, the Joint Fiscal Office reviewed the statutory forecast and reminded legislators that the projection is not final and it does not set tax bills. It is simply the first estimate school boards use when building local budgets.

The briefing also outlined next steps required under Act 73. Many pieces of that law were designed to take effect over several years and require follow-up work on funding, governance, district structure and how the new formula will function. Those timelines and work products will come back to the Legislature this session for decisions.

This begins the annual education tax process. School boards will finalize budgets, voters will decide them in March, and the Legislature will set final yields and rates before June 30.

A note on TIF and CHIP

I am already hearing some legislators say our infrastructure investment programs, TIF and CHIP, are contributing to the projected increase in taxes.

This is not accurate.

These important development programs help towns make investments in housing and infrastructure that grow the grand list. The new growth produces new revenue, and a portion of that new revenue is used to pay for the project. Without the investment, that growth would not occur. The result is not lost revenue, but a slower increase than if the state/town received all of the new growth immediately. These tools help communities expand their tax base over time so local costs are carried by more taxpayers.

JFO Briefing

On Wednesday I attended the Legislature’s pre-session fiscal and policy briefing. We heard directly from state economists, fiscal analysts and health care leaders about what Vermonters should expect heading into 2026. Vermont revenues are essentially on target and about 8 million ahead, but there are clear pressures on the horizon.

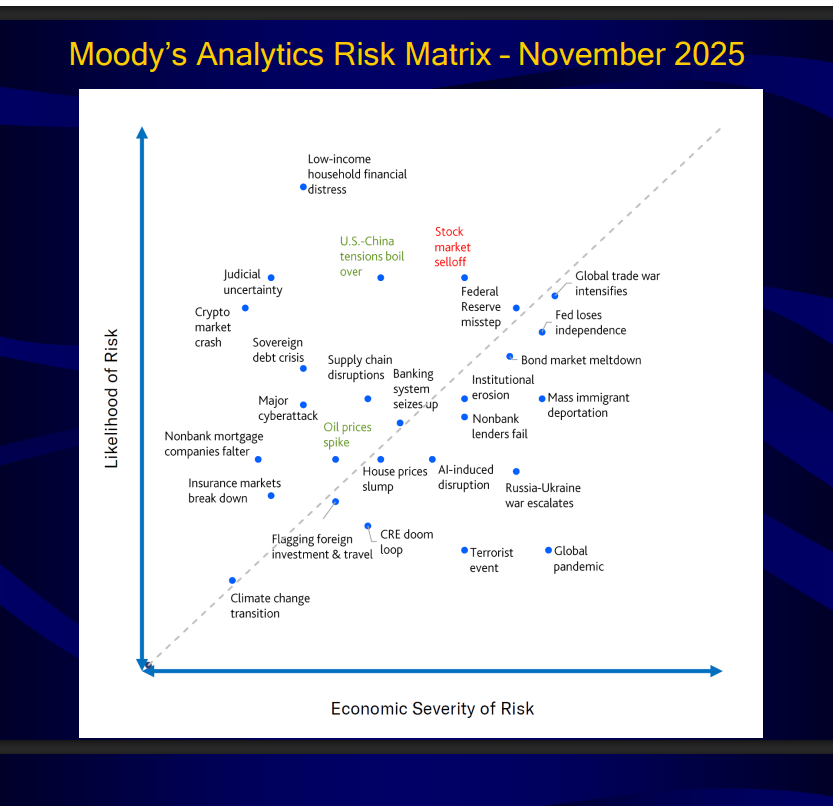

Moody’s analysis (above) shows national risks that directly affect our state. Rapid advances in artificial intelligence, new global tariffs and slowing immigration are creating headwinds for growth. These shifts are already showing up in workforce shortages, higher costs for equipment and construction and increased strain on local businesses that cannot find enough workers.

One point in the December 2025 Legislative Economic Review from economist Tom Kavet stood out. More than half of all consumer spending in the United States is coming from the highest earning ten percent of households. That concentration has real consequences for affordability and for the small businesses that depend on steady local spending. When growth relies too heavily on a small slice of the population, we all feel economic slowdowns faster.

The message for Vermonters: federal dollars are shifting, revenue pressures are building and major decisions on education funding and health care costs cannot be postponed.

Additional presentations from the fiscal briefing:

- Fiscal Year 2027 Budget Context

- FFIS- Current Issues in State-Federal Fiscal Relations

- State of Health Care in Vermont

New Reports to the Legislature

Energy Costs and What the New Reports Show

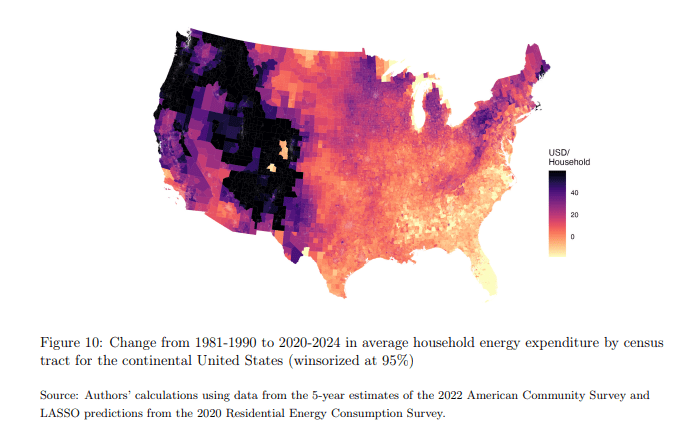

Three major studies over the last few years have reached the same conclusion: Vermont families are paying too much for energy, and the biggest drivers are older homes, heavy use of delivered fossil fuels, and long rural commutes. That is the shared finding of Act 62, the Clean Heat Standard analysis, and the newly released Act 142 of 2024: Energy Cost-Stabilization Study.

All three agree on the most reliable way to lower energy costs: help Vermonters use less energy through weatherization, efficient heating systems, and better transportation options. They also agree that rural and low income households need protections. Where they differ is on which policy tools get us there and how to pay for the work.

The Act 142 report stresses the need for long term funding for weatherization, heating upgrades, and transportation programs. The Clean Heat Standard would require fuel suppliers to help customers cut energy use rather than asking taxpayers to fund a new system and Act 62 emphasized the need for guardrails to protect rural households and strong oversight so Vermonters see real savings. I have linked all three reports below.

- Act 142 of 2024: Energy Cost-Stabilization Study

- NV5 – VT PSD Clean Heat Standard Report PSD FINAL.pdf

- REPORT on the CLEAN HEAT STANDARD UNDER ACT 18 of 2023, SECTION 6(i)

A new national climate analysis confirms something rural Vermonters already understand. The highest costs right now are not from gradual warming but from climate-driven extreme weather and disaster events, including flooding and wildfire smoke.

The study also finds that lower-income and rural households feel these impacts more quickly and have fewer resources to recover. That matches what we see in our river valleys, hill towns and dirt road networks after recent floods.

For those who want to dig deeper, the report outlines how climate disruptions are already shaping local government budgets, emergency capacity and long-term planning. It is worth a read for anyone following Vermont’s recovery work, infrastructure needs and rural resilience conversation.

Tobacco and Nicotine Trends in Vermont

Dover: Saturday, December 6, 11 AM–12 PM | Dover Free Library

Wardsboro: Thursday, December 18, 6–7 PM | Wardsboro Library

From January to May, regularly scheduled in person office hours will only take place on the 1st Saturday in Dover. I am in Montpelier from Monday evening to Friday evening when the legislature is in session.

If you need help with state services, please reach out. I do not have staff and I work year-round, so if you do not hear back in a day or two, please follow up or send a text. If you find my work useful and are able to support it, you can do that here.

Thank you for staying engaged and looking out for one another. That is how Vermont gets through hard times and solves problems.

Rep. Laura Sibilia

Windham-2 District (Dover, Jamaica, Somerset, Stratton, Wardsboro)

Email: lsibilia@leg.state.vt.us

Phone: (802) 384-0233

Only are weekend dog walks are in the light this time of year!

Discover more from Vermont State Representative Laura Sibilia

Subscribe to get the latest posts sent to your email.