Dear friends and neighbors,

Wishing you a peaceful and meaningful Mother’s Day. I’m grateful to be spending time with some of my kids, my mom and my-mother-in-law this weekend. As we approach the final weeks of the 2025 legislative session, I’m sharing updates on key bills and topics Vermonters have been raising with me.

Thank you to everyone who came to office hours in Dover last week. I’ve recently heard from constituents at meetings in Dover and Jamaica about a wide range of issues, including federal law enforcement activity in the state, federal impacts to FEMA, weatherization assistance for low-income households, emergency dispatch modernization, and questions about the big education transformation bill currently under review in the Senate.

I’ll be stopping by the Wardsboro Plant Sale on Saturday, May 24, in the morning. The event runs from 9 a.m. to 1 p.m. at the Wardsboro Library (170 Main Street), and I hope to see you there!

This week, I had the opportunity to attend the launch of the Vermont Immigration Legal Defense Fund at the Statehouse in Montpelier. The fund, which aims to raise $1 million, will provide critical legal services to immigrants across the state. Mohsen Mahdawi, who was recently detained by federal authorities, spoke at the event about the importance of legal support for vulnerable communities. The fund will benefit organizations like the Vermont Asylum Assistance Project, which has already supported over 300 people. Donations to the fund will be managed by the United Way of Northwest Vermont. To contribute, visit the fundraising page here.

In this update:

- Proposal 3: Collective Bargaining Rights

- Education Update: Senate Reviewing H.454 – Vacancy Tax proposed

- New Housing Targets and Development Dashboard

- Weatherization Assistance in Windham and Bennington Counties

- Wildlife Management Bill (H.706)

- Artificial Intelligence in State Government

- Tax Relief for Families, Seniors, and Veterans Passes

- Emergency Dispatch Modernization

- Know Your Rights: Protesting and Detention

Proposal 3: Collective Bargaining Rights Amendment

What the amendment does

Proposal 3 would amend the Vermont Constitution to recognize a right for employees to organize and engage in collective bargaining. This change would put those rights in the state constitution, adding to the legal protections that already exist in state and federal labor law.

Where it is in the process

This proposal passed the House and Senate in 2024. Because it’s a constitutional amendment, it needed to pass both chambers again in this legislative session, and it has 125-15 in the House and 29-0 in the Senate. It will now go to Vermont voters in November 2026 for a final decision.

Link to proposal PR.3 – Vermont Legislature

Following Education in the Senate: H.454 – A Bill to Transform Vermont’s Education System

Senator Kesha Ram Hinsdale has introduced a proposed amendment to the education bill currently under consideration in the Vermont Senate Finance Committee. The amendment would impose a 1.25% annual surcharge on the equalized grand list value of certain vacant commercial and residential properties across the state.

Key Provisions:

- Vacant Commercial Properties: Includes buildings such as hotels, offices, or retail spaces that sit mostly unused for more than 183 days in a calendar year.

- Vacant Residential Properties: Year-round habitable homes that are not claimed as a homestead and not rented (no landlord certificate filed).

- Mixed-Use Exemptions: Parcels are exempt if any portion is in active use; the surcharge applies if all parts meet the vacancy definition.

- Filing Requirement: All property owners must annually report property use status to the Tax Department; false reporting can result in penalties and up to a $1,000 fine.

- Revenue Allocation:

- 80% directed to the Education Fund.

- 20% allocated to the Vermont Housing and Conservation Trust Fund for affordable housing development.

Status of the Education Bill:

The broader education bill is currently being reviewed by the Senate Finance Committee, which is considering various revenue options to stabilize and fund Vermont’s education system. The addition of the vacancy surcharge amendment introduces a potential new revenue stream aimed at both generating funds and incentivizing the use of underutilized properties.

Here is a current side by side view of the House and Senate Versions

Vermont has released new regional housing targets and launched a first-of-its-kind Housing Development Dashboard to track progress in near real time. The state needs to build 8,200 homes per year to meet its 2030 goal—but is currently producing just 27% of that. Clicking on the image below will take you to the main site.

Weatherization Assistance in Windham & Bennington Counties

Vermont offers programs to help income-eligible households in Windham and Bennington counties improve home energy efficiency and reduce heating costs.

Home Weatherization Assistance Program (WAP)

WAP provides free energy-efficient upgrades to eligible households. In Windham and Bennington counties, BROC Community Action and SEVCA administer this program based on income guidelines (80% of Area Median Income). Priority is given to households at or below 60% of AMI.

Income Limits and Eligibility:

- Windham County: Up to $61,050 for a single-person household

- Bennington County: Up to $66,600 for a single-person household

- Income at or below 80% AMI

- Be an active Seasonal Fuel Assistance recipient.

- Receive Supplemental Security Income (SSI)

- Received Reach Up or Reach First assistance

How to Apply: SEVCA: Windham & Windsor counties, contact at 1-800-464-9951 BROC Community Action: Bennington & Rutland counties, contact at 802-665-1748

Wildlife Management Updates Bill (H.706)

This week the House passed over to the Senate about the management of wildlife. The bill did not make cross over, so it seems unlikely to be voted on by the Senate this year. You can read the bill and here is the Fiscal note.

What the bill does:

- Updates how Vermont manages all types of wildlife, including reptiles and amphibians.

- Clarifies the authority of the Fish and Wildlife Commissioner to adopt rules related to wildlife management.

- Outlines penalties for the illegal taking, possession, or sale of wildlife.

- Reaffirms the right of farmers and landowners to protect crops and livestock from wildlife damage.

- Makes technical updates to ensure consistency in wildlife-related statutes and enforcement.

What’s the point?

- Provides clearer guidelines for the conservation and management of all wildlife species.

- Ensures consistent enforcement of wildlife laws across the state.

- Updates language and practices in line with current scientific understanding and legal standards.

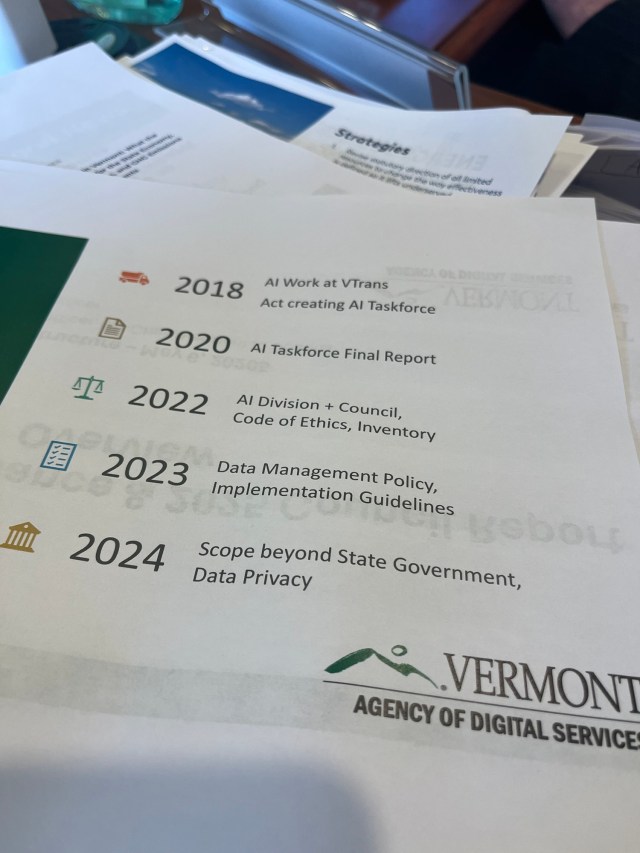

Artificial Intelligence in Vermont

This week, our committee heard testimony about Vermont’s Division of Artificial Intelligence — a department I helped establish through Act 132 in 2022. Vermont’s approach to AI is guided by two complementary bodies: the Council on Artificial Intelligence, which includes a diverse range of Vermonters who provide oversight and direction, and the Division of Artificial Intelligence within the Agency of Digital Services, which puts that guidance into practice.

The state’s goal is to use AI to improve services while remaining a national leader in thoughtful, ethical use of technology in government. Vermont’s AI Code of Ethics requires all systems to be be human-centered, uphold the dignity and rights of every person, and comply fully with state and federal law.

You can learn more about the Division and Council on Artificial Intelligence here: https://ai.vermont.gov

Bipartisan Tax Relief for Vermont Families, Seniors, and Veterans Advances

This week, the Vermont House passed S.51 with a vote count of 142-2, bringing important tax relief to Vermont families, seniors, and veterans. These tax credits will provide substantial financial relief to working families, seniors, and our veterans. The Senate will still need to agree to these credits, but the Governor has indicated his support, having long championed some of these provisions, especially the military and survivor exemptions.

Here’s what’s in the bill:

- Child Tax Credit (CTC):

- Expansion: The age eligibility for the CTC is raised from five to six years old. This change allows more families to claim the $1,000 per child refundable credit.

- Earned Income Tax Credit (EITC):

- Expansion: For claimants without children, the EITC will be increased from 38% to 100% of the federal amount.

- Social Security and Civil Service Retirement System (CSRS) Exemptions:

- Expansion: The income thresholds for exemptions on Social Security and CSRS benefits will be increased by $5,000.

- Military Retirement and Survivors’ Benefits Exemption:

- Expansion: The bill increases the exemption for military retirement benefits and survivors’ benefits, allowing veterans with an AGI below $125,000 to fully exempt their military income, with a partial exemption phasing out up to $175,000. It also removes the $10,000 cap on military retirement income exemptions.

- Veteran Tax Credit:

- New Credit: A $250 refundable credit for veterans with an AGI below $25,000. Those with an AGI between $25,000 and $30,000 can receive a partial credit.

I spoke in support of the military survivor and retiree benefit exemption on behalf of the Vermont National Guard and Veterans Affairs Caucus.

Military service often involves a lifetime of sacrifice. Service members don’t just serve; their families do too. They move from duty station to duty station, often putting personal and professional goals on hold in service to our country. Spouses see their careers disrupted, limiting their long-term earnings and stability. Children grow up across multiple states and countries before they can finally settle in one place. And those who have served in multiple combat deployments often face life-altering and life-shortening impacts. I have seen these realities firsthand in my own family, and I know many others in this chamber have as well.

Forty-seven other states have already recognized this unique service and acted

Madame speaker, On behalf of the VTNG and VA Caucus, thank you and the ways and means committee for finally bringing forward legislation to stop the taxation of military survivor benefits and most military retiree pay. – Rep. Laura Sibilia

Vermont’s Emergency Dispatch System: What Comes Next

Earlier this spring, the Public Safety Communications Task Force released its draft report on the future of Vermont’s emergency dispatch system. That report recommends consolidating the current 37 dispatch centers down to just six regional hubs — a major shift that will affect communities across the state, particularly in rural areas.

While the official comment period closed in April, I want to underscore that your input still matters. Operational decisions, funding allocations, and implementation timelines are ongoing — and we need to stay engaged.

The report clearly outlines structural problems that need to be addressed: inadequate staffing, aging technology, security concerns, and inconsistent 24/7 coverage. But as we move toward solutions, we must ensure local knowledge, regional equity, and rural realities aren’t lost in the process.

If you or your community didn’t get a chance to submit formal feedback, I still want to hear from you. I’ll be continuing to monitor developments.

Vermont Public: Public safety report says Vermont’s dispatch system needs an overhaul

View the full Task Force materials and report: Public Safety Communications Task Force Main Page

Protecting yourself when protesting, Know Your Rights: What to Do if You or a Loved One is Detained

Federal Funds under the Trump Administration

This is a live webpage from the Joint Fiscal Office dedicated to tracking the impact of federal policy on states. The current presidential administration has issued executive orders freezing federal funds, discussed the elimination of federal programs, and has proposed significant changes to tax policy. Congressional budgetary actions could further impact states.

Recent Reports to the Legislature

Overdose Prevention Center Pilot Grant Progress Report: May 2025 The Vermont Department of Health submitted a progress report on May 1, 2025, to update the Legislature on the implementation of Act 178 (2024), which authorizes a pilot overdose prevention center in Burlington. Since January, the Department has worked closely with the City to support development of a compliant proposal, which was formally approved by the Burlington City Council and submitted on April 29. The Department is reviewing the proposal and expects to finalize a grant agreement by July 1, 2025. Separately, an independent evaluation led by the Pacific Institute for Research and Evaluation (PIRE) began in fall 2024, with an initial report submitted to the Legislature in January. Although Vermont was not selected for inclusion in the national SAFER study due to funding limits, the Department and PIRE will continue collaborating on required annual evaluations and exploring future research partnerships.

Bills That Have Passed Into Law and Signed by Governor

- H.21 An act relating to service of writs of possession

- H.243 An act relating to the regulation of business organizations

- H.118 An act relating to expanding the scope of hate-motivated crimes

- S.30 An act relating to updating & reorganizing the health insurance statutes in 8 V.S.A. chapter 107

- S.9 An act relating to after-hours access to orders against sexual assault

- H.259 An act relating to preventing workplace violence in hospitals

- S.3 An act relating to the transfer of property to a trust

- H.80 An act relating to the Office of the Health Care Advocate

- H.154 An act relating to designating November as the Vermont Month of the Veteran

- H.2 An act relating to increasing the minimum age for delinquency proceedings

- H.31 An act relating to claim edit standards and prior authorization requirements

- H.35 An act relating to unmerging the individual and small group health insurance markets

- H.78 An act relating to the use of the Australian ballot system in local elections

Latest OPEDs from Laura

- Sibilia: Due process, free speech and legal presence

- Sibilia: Know Your Rights When Interacting with Law Enforcement

- Sibilia: Fighting for Climate Justice and State Autonomy

During the 2025 legislative session from January through May I will continue to meet on the 1st Saturday of the month at the Dover Free Library from 11-noon and at your group’s invitation as schedules allow.

Monitor my votes and the bills I am sponsoring at: https://legislature.vermont.gov/people/single/2026/24023

As always, if you have suggestions, concerns or critiques please be in touch so we can schedule one on one time to discuss. Please do not hesitate to contact me if you need assistance navigating government services at (802) 384-0233 or lsibilia@leg.state.vt.us. Follow my regular posts online at http://www.laurasibiliavt.com

Discover more from Vermont State Representative Laura Sibilia

Subscribe to get the latest posts sent to your email.