Dear friends and neighbors,

I hope you are well and enjoying the increasing Spring sunlight! In addition to a busy few days, my birthday was this week, and I’m looking forward to celebrating with some quiet time with my family this weekend.

There’s a lot happening in the legislature right now. Below you will find information on the House passed versions of the FY 26 Budget and Yield Bill, updates on stormwater, PILOT fund surplus and information on protecting your data.

Legislators are beginning to get some analysis from the Joint Fiscal Office on the impact of federal policy on states. I’m organizing community forums to explore ways we can strengthen local mutual aid networks and support one another in the face of potential federal funding impacts. Meetings are being planned for community members in Dover, Jamaica, Wardsboro, and Stratton – more details to come. If you know of a similar effort underway in your community already, if you’d like to help or have ideas to share, I’d like to hear from you – please email me at lsibilia@leg.state.vt.us

I’ve also heard from many of you with concerns about Social Security, and I share those worries. The recent closures of offices, loss of staff, and changes to phone systems are unsettling. While Social Security is a federal issue, I know Senators Sanders, Welch, and Congresswoman Balint are all actively working to protect it. If you’re facing difficulties, please don’t hesitate to reach out to their offices, and if you need help contacting them, I can assist. I know how stressful this situation is becoming, and I’m sorry for the anxiety many of you are feeling.

A reminder that my next regularly office hours are Saturday, April 5th at 11 am at the Dover Free Library. Please come by and share what’s on your mind.

Finally, The U.S. Army Corps of Engineers (USACE) is hosting an open house on Tuesday, April 15, 2025, from 4:00-6:00 p.m. at Jamaica Town Hall (3735 VT Route 30, Jamaica, VT) to begin updating the 1977 Ball Mountain Lake Master Plan. There will be no formal presentation. Attendees can drop in anytime to speak with USACE team members, learn about the revision process, and share feedback. Read the release

The future of our democracy depends on our ability to bridge divides and prioritize unity over

partisanship. We must rebuild trust, restore faith in our institutions, and create a government that

serves all Americans. Change begins with us- and we call and act for a system that brings us

together, not tears us apart. – Ely White, Leland and Gray Union Middle High School, Senior and 3rd place winner Senator Sanders 2025 State of the Union Essay Contest

Budget

This week we voted to pass the FY 2026 budget with a tri-partisan vote of 104-38. The bill was previously voted out of the Appropriations Committee 11-0. This unanimous vote reflected a lot of compromise. The bill will head next to the Senate Appropriations Committee. The fiscal year 2026 budget is based on $2.64 billion in General Fund revenue, including the $2.4 billion January 2025 consensus forecast, $113.6 million from other sources, and $136 million in carry-forward funds.

Key Highlights

- Housing: Fully funds the Vermont Housing and Conservation Board at $36.9 million, allocates $30.5 million for emergency housing, and invests $10 million in middle-income homeownership development.

- Healthcare & Human Services: Provides $15.4 million for nursing home rate increases, $4.5 million for FQHC rate adjustments, and $5.1 million for mental health service provider increases.

- Other Investments: Transfers $77.2 million to the Education Fund for property tax reform, allocates $5 million to Vermont State Colleges for transition funding, and designates $1.1 million for the Truth and Reconciliation Commission.

- H.493 FY26 Budget – As Introduced

- H.493 Web Report

- H.493 Highlights

Yield Bill

This week, the House advanced H.491, the annual property tax bill that sets the homestead property tax yields and the nonhomestead property tax rate. I supported this bill, which includes the Governor’s proposal to use $77 million in one-time General Fund dollars to reduce this year’s tax rate. This measure aims to lower the average property tax increase from around 6% to approximately 1.1%, though actual rates will vary by district.

For fiscal year 2026, H.491 sets the property dollar equivalent yield at $8,596, the income dollar equivalent yield at $12,172, and the non-homestead property tax rate at $1.703. These levels are expected to fully fund the Education Fund.

The bill now moves to the Senate, where its outcome remains uncertain. The Senate’s decision will be crucial in determining the final property tax rates and the overall impact on education funding. I will continue to monitor the bill’s progress and provide updates.

At the same time, it’s clear that a major overhaul of our education system is needed, and that process will take time. We expect to see an education reform bill from the House next week. Today, I received a note from a constituent urging me to oppose *any* House education bill. I always appreciate hearing from constituents, and I encourage folks to share their specific concerns – what you support, what you oppose, and why. That information helps me better represent our communities and make informed decisions.

Update on Local Option Tax (LOT) & PILOT Reform

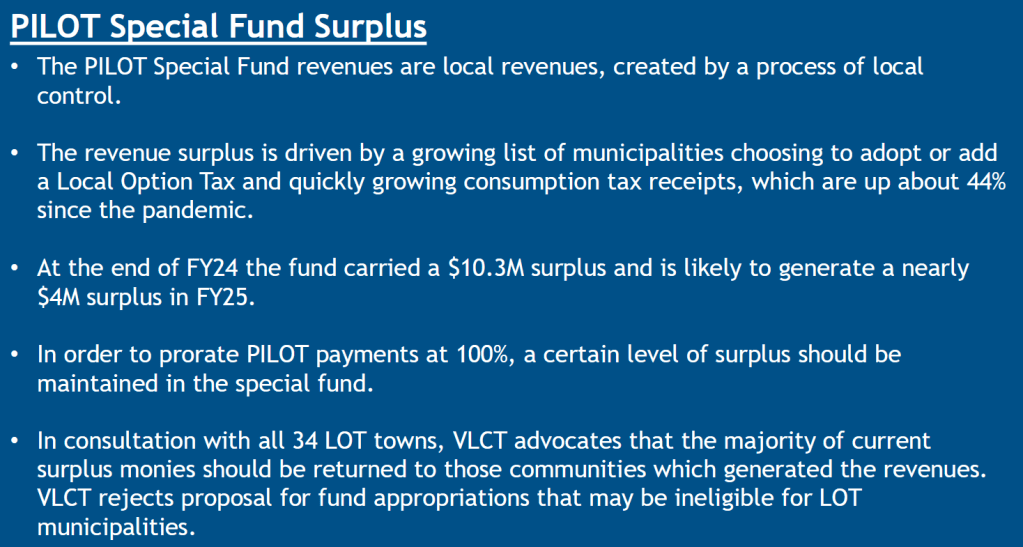

As many of you know, the Local Option Tax (LOT) allows municipalities to generate revenue by adding a 1% tax on sales, meals, alcoholic beverages, and rooms. In Southern Vermont, towns like Dover, Stratton, Jamaica, and Wardsboro have been benefiting from this system. However, the state’s Payment in Lieu of Taxes (PILOT) program has accumulated a nearly $10 million surplus, meaning that our nine rural communities are overpaying into the system.

The good news is that the formula for LOT distribution is being revisited. A proposed update to the formula in H.397, which is currently under review in the Vermont Legislature, would change the split to 75% for local communities and 25% for PILOT. However, there is no plan yet to return the growing surplus to the towns that have over-contributed. H.397 is titled An Act Relating to Miscellaneous Amendments to the Statutes Governing Emergency Management and Flood Response. It includes a variety of provisions beyond the LOT reform. It proposes to establish Voluntary Buyout and Voluntary Buyout Reimbursement programs for flood-prone properties, create additional positions at Vermont Emergency Management, and grant more fiscal authority to municipalities. These changes are meant to improve flood response and emergency management across the state.

I am staying in touch with the Vermont League of Cities and Towns (VLCT) and the Ways & Means Committee to ensure that we address this issue. For the latest updates on the bill and its fiscal implications, you can view the full fiscal note here. Stay tuned as we push for a solution that better supports our communities.

State Advertising Contracts

This week, the House supported H.244, a bill that sets new standards for state advertising contracts. The bill would ensure that 70% of state advertising dollars stay in Vermont, supporting local news and broadcast organizations. There are exemptions for tourism ads and job postings, and the state will now be required to report annually on advertising expenditures. H.244 now moves to the Senate.

Update on Vermont’s Storm water Bill

H.481, deals with Vermont’s storm water management. This legislation proposes extending the deadline for property owners with three or more acres of impervious surfaces to obtain necessary storm water permits from 2023 to 2028. It also allows municipalities that take full legal responsibility for storm water systems to assess impact fees on users and access funding from the Clean Water Fund. Additionally, the bill seeks to maintain the current Clean Water Surcharge rate of 0.22% by removing the planned reduction to 0.04% in 2027 and eliminating the 2039 sunset clause. Furthermore, it establishes a study committee to evaluate the feasibility of creating regional storm water utility districts.

For a detailed fiscal analysis of H.481, please refer to the fiscal note.

23andMe Bankruptcy: Protect Your Data

The genetic testing company 23andMe has filed for Chapter 11 bankruptcy, raising concerns about the future of its massive genetic data trove. Privacy advocates warn that customers should take steps to download and delete their data, as the company’s new ownership could change how that information is handled. Currently, only California and Washington state have strong legal protections for consumer health data.

If you or someone you know has used 23andMe, I encourage you to review your data privacy settings. Learn more and access instructions here.

Federal Executive Order on Voting

In the U.S., states primarily manage elections, setting rules for voter qualifications, ballots, and procedures. The Constitution gives state legislatures the authority to determine election times, places, and manners. However, Congress regulates aspects like campaign finance, voting rights, and election security, and provides support through agencies like the Election Assistance Commission. President Trump’s latest voting executive order requires documentary proof of citizenship for voter registration and mandates ballots be received by Election Day. This could disenfranchise millions of voters, particularly those without easily accessible proof of citizenship, including married women whose birth certificates list maiden names. Legal challenges are expected as states traditionally control election rules. Vermont’s Secretary of State issued a statement yesterday about this order.

How to Prove U.S. Citizenship

To prove citizenship, you can use:

- Birth Certificate (from the state where you were born)

- U.S. Passport

- Naturalization Certificate

- Certificate of Citizenship

- Consular Report of Birth Abroad (CRBA) (for those born outside the U.S.)

If needed, request certified copies from the appropriate agency. Married women may need both their birth and marriage certificates to link their maiden and current names.

Recent Reports to the Legislature

JFO 2025 TIF Report – An Examination of Tax Increment Financing in Vermont: Vermont’s Tax Increment Financing (TIF) program funds infrastructure projects using future property tax revenue growth and currently includes eight districts. Since the last report in 2022, Barre and Hartford received tax retention extensions due to pandemic-related delays, while Montpelier and Bennington discontinued their districts. The program continues to impact Vermont’s Education Fund, with estimated forgone revenue between $4.5 million and $8 million annually over the next five years. While TIF has been linked to increased property values, broader economic benefits like job growth are less clear. The report also highlights TIF’s role in infrastructure financing, especially as federal funds decline, and notes financial risks in districts like Barre and Killington if projected development revenue falls short.

Bills That Have Passed Into Law and Signed by Governor

- H.31 An act relating to claim edit standards and prior authorization requirements

- H.35 An act relating to unmerging the individual and small group health insurance markets

- H.78 An act relating to the use of the Australian ballot system in local elections

During the 2025 legislative session from January through May I will continue to meet on the 1st Saturday of the month at the Dover Free Library from 11-noon and at your group’s invitation as schedules allow.

Monitor my votes and the bills I am sponsoring at: https://legislature.vermont.gov/people/single/2026/24023

As always, if you have suggestions, concerns or critiques please be in touch so we can schedule one on one time to discuss. Please do not hesitate to contact me if you need assistance navigating government services at (802) 384-0233 or lsibilia@leg.state.vt.us. Follow my regular posts online at http://www.laurasibiliavt.com

Discover more from Vermont State Representative Laura Sibilia

Subscribe to get the latest posts sent to your email.

Happy Birthday! Thanks for all you do Deb