Good evening,

This week there will be a Joint Assembly to hear the Governor’s Budget Message, Tuesday, January 23, 2024 at 1:00 P.M. To view the Joint Assembly proceedings, go to the following YouTube channel: https://legislature.vermont.gov/senate/streaming/joint-assembly A reminder that it is the Governor’s job to propose a budget to run state government. It is the Legislature’s job to consider the Governor’s budget, make suggested changes and then appropriate tax dollars for the budget – first in the House and then in the Senate. In an ideal world the governor’s staff is working with legislators and legislators are working with the Governor’s staff on passing a budget the is acceptable to both the Governor and the people’s representatives.

Recent reports to the Legislature:

- Agency of Commerce: DESIGNATION 2050 – Vermont State Designation Program Evaluation and Reform

- Vermont Climate Council: Vermont Climate Council Legislative Report for 2023

- Vermont Department of Taxes: Property Valuation and Review Annual Report

Land Use Regulation

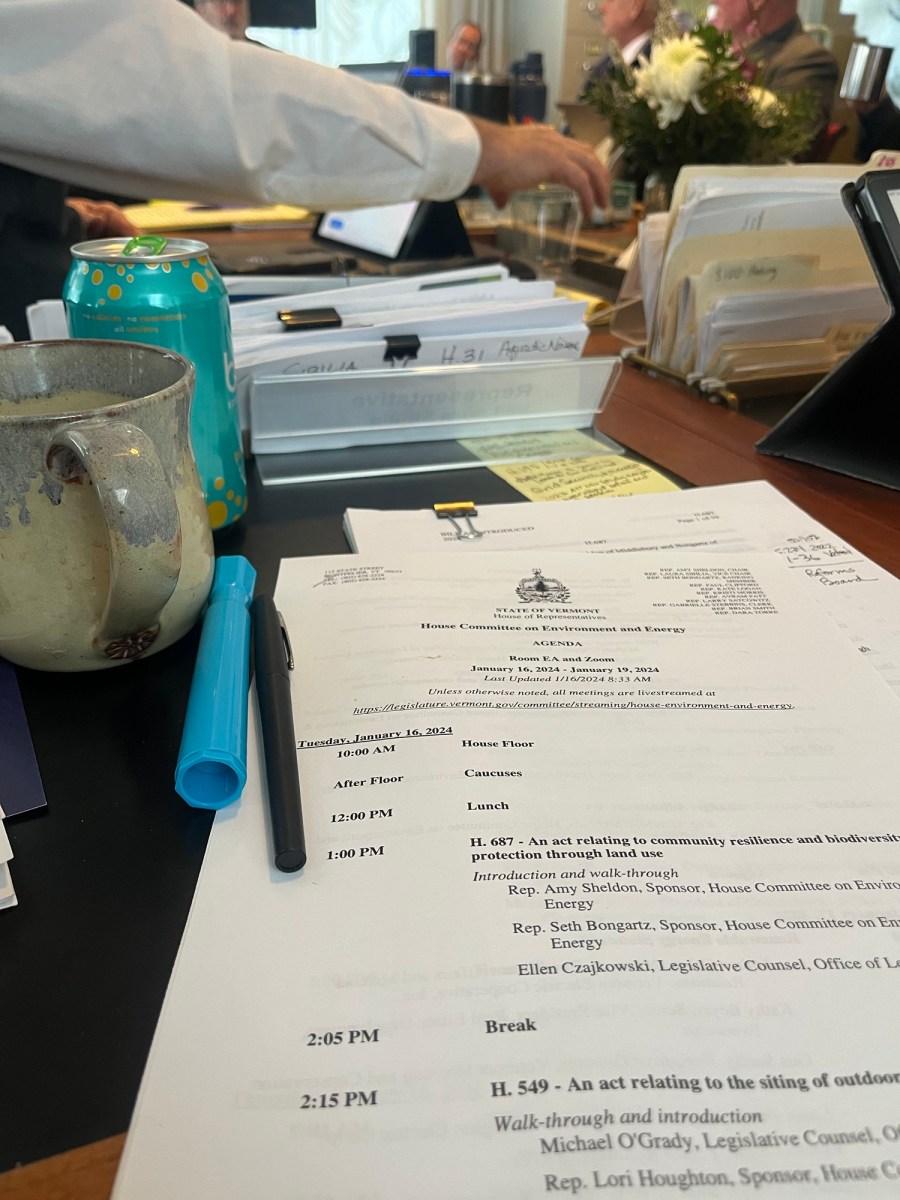

There are massive land use regulation changes that have been proposed and that are underdevelopment. These changes are being driven by development, conservation and climate change needs. Larger towns and cities with water and sewer infrastructure and robust zoning are proposed to have less Act 250 jurisdiction in their downtowns. Smaller towns with some infrastructure and zoning may be able to pursue Act 250 exemption. Rural Vermont is proposed to see significant increase in Act 250 jurisdiction. A state takeover of river corridor permits and increased wetlands regulation are in development. I will be holding at least one public information session on this topic Saturday, February 3rd during my regular office hours in Dover at 11 am, and hope to have virtual/public meetings in our other district towns. More details on these info sessions in the coming week. Please be in touch if you have an interest in testifying on these proposals.

Education Spending / Property Taxes

A major issue being highlighted at the statehouse continues to be school budgets and property taxes. I previously wrote about this issue in an op-ed that considered the compounding problem that a lack of statewide leadership has had as our districts face myriad challenges, and an end to years of federal assistance and the legislature buying down property tax rates: Rep. Sibilia: About that December 1 Letter from the Tax Commissioner…

On Wednesday of this week, The Vermont School Boards Association sent out an appeal for careful consideration to school boards:

“The VSBA has a longstanding history of promoting equity of educational opportunity for students throughout Vermont. It can be seen in the association’s belief and vision statements as well as resolutions passed by members.

In 2022, the Legislature passed Act 127 with the goals of increasing educational equity, improving educational outcomes, improving transparency in the distribution of financial resources to school districts and enhancing educational and financial accountability (see section 2 of the Act for details on the stated goals).

Section 3 of Act 127 covers the intent of the Act and states “This act updates and adds new pupil weights for fiscal year 2025 and thereafter. Because this change will affect homestead property tax rates, this act limits the degree to which these rates can increase over fiscal years 2025–2029.”

Under Section 7 of Act 127, if the increase in a school district’s homestead property tax rate from FY24 to FY25 is greater than 5%, the district is protected by a maximum allowable increase of 5%. That can last up to 5 years, but once the district is at the actual rate, the 5% provision is no longer available. The 5% provision was intended to ease the transition for districts that lost tax capacity due to the changes in the weights. It was not intended to grant school districts the ability to add expenses to their budgets that are unrelated to the transition. Additionally, there is a tax rate review process for per pupil spending increases of more than 10% from year to year.

More information about how the 5% and 10% provisions in Act 127 are impacting school district budgets and our statewide education funding system is becoming available every day. Based on the latest information, it appears that most budgets being approved by school boards are falling above the 5% cap. The cumulative effect is a dramatic and unanticipated increase in education spending statewide. When districts use the 5% cap, their spending above 5% is not raised by their communities – it must be made up elsewhere. Put another way, we are all interconnected by Vermont’s statewide Education Fund.

Given the anticipated unprecedented rise in education spending by districts that exceed the 5% cap, it is possible that the Legislature will revisit the provisions of Act 127 during this legislative session. Therefore, we strongly recommend careful consideration of whether your budget contains additional spending that was added in order to take advantage of the 5% cap.”

On Friday, the VSBA sent out a letter from the Chairwomen of the Senate and House Taxing Committees: http://link.vtvsba.org/CummingsKornheiser.pdf They announced a public joint hearing on the issue for Thursday, January 25th at 1 pm

One of the outcomes of a potential unexpected massive increase in education spending this year is a likely spike in the non-homestead tax rate. This is becasue so many Vermonters property taxers are offset by income insensitivity.

Water quality plan for Deerfield, Connecticut Rivers under discussion

State planners and regional water quality partners are hosting a virtual meeting on Wednesday, Jan. 24, at 6 p.m. to introduce the state’s kick-off of the update to the Tactical Basin Plan for the Deerfield and lower Connecticut Rivers and adjacent Connecticut River Tributaries (Basin 12).

This plan is being developed to protect and restore rivers, lakes, and wetlands in southeastern Vermont from Stratton to Vernon. Register in advance for this meeting at bit.ly/748-river.

The public is invited to provide input on regional water quality and river habitat concerns. Watershed Planner Marie Caduto will present an overview of the current conditions in the watershed and provide an update on the progress made since the 2020 plan was implemented. Input can be submitted during the meeting or via email to Marie.Caduto@vermont.gov or mailed to Marie Caduto, Basin 10 Comments, Vermont Department of Environmental Conservation, 100 Mineral St., Suite 303, Springfield, VT 05156.

The Tactical Basin Plan identifies actions that will protect or improve rivers, lakes, and wetlands through cost-effective projects, including floodplain restorations and dam removals.

The plan will set priority strategies focused on water quality and aquatic habitat to be implemented over the coming five years. One such project identified in the previous plan is the floodplain restoration work being implemented on Birge Street in Brattleboro. Pre-register for the Jan. 24 meeting through the Windham Regional Commission at windhamregional.org.

GOVERNOR PHIL SCOTT AND THE HARTFORD ANNOUNCE FEBRUARY LAUNCH OF VERMONT FAMILY AND MEDICAL LEAVE INSURANCE PROGRAM FOR EMPLOYERS

Montpelier, Vt. – Governor Phil Scott and The Hartford, a leading provider of employee benefits and leave management, will begin offering the Vermont Family and Medical Leave Insurance (FMLI) program for employers on February 15. Employers with two or more employees will have the opportunity to design a plan to fit the needs of their employees and business, with benefits beginning on July 1.

“Providing all Vermonters with access to affordable paid family and medical leave, without imposing a new mandatory tax, is truly a win-win,” said Governor Scott. “I’m excited to move forward with this new phase of the Vermont Family and Medical Leave initiative and look forward to Vermonters benefitting from the program for years to come.”

“The Hartford is pleased to start the next phase of Vermont’s innovative Family and Medical Leave Insurance program and expand these crucial income protection benefits to more workers across the state,” said Megan Holstein, head of Absence Management for Group Benefits at The Hartford. “Our team is dedicated to helping brokers and their employer clients design paid leave programs to help employers support their workforce and attract and retain talent, while providing peace of mind for employees who need to take time away from work to care for themselves or their loved ones.”

The FMLI benefits provide partial income replacement for workers who need to take care of a family member with a serious health condition, bond with a new child, tend to their own serious health condition, care for a military service member’s serious injury or illness, or address certain needs related to a family member’s covered active military duty or call to active duty.

The FMLI plans are flexible, which allow employers who opt in to design a plan that best meets the needs of their business and employees. Some key features include:

- Option to provide family and medical leave combined or stand-alone family leave insurance;

- Contributions can be fully paid by the employer, split between the employer and employees, or fully paid for by the employees as a voluntary benefit;

- Benefit duration options of six to 26 weeks per 12-month period; and

- Sixty to 70% wage replacement, with additional options available with underwriting review.

The first phase of the program was implemented for Vermont State employees in July 2023. In the final phase of the program, FMLI benefits will be made available for individual workers in the state of Vermont who do not have access to them through their employer, self-employed individuals and employers with fewer than two employees, to purchase in 2025 with benefits beginning on July 1, 2025.

Employers in Vermont can work with their employee benefit brokers to learn more about the Vermont FMLI program or visit https://fmli.thehartford.com.

As always, if you have suggestions, concerns or critiques please be in touch so we can schedule time to discuss. Please do not hesitate to contact me if you need assistance navigating government services at (802) 384-0233 or lsibilia@leg.state.vt.us. Follow my regular posts online at http://www.laurasibiliavt.com

Rep. Laura Sibilia – Dover, Jamaica, Somerset, Stratton, Wardsboro

Discover more from Vermont State Representative Laura Sibilia

Subscribe to get the latest posts sent to your email.