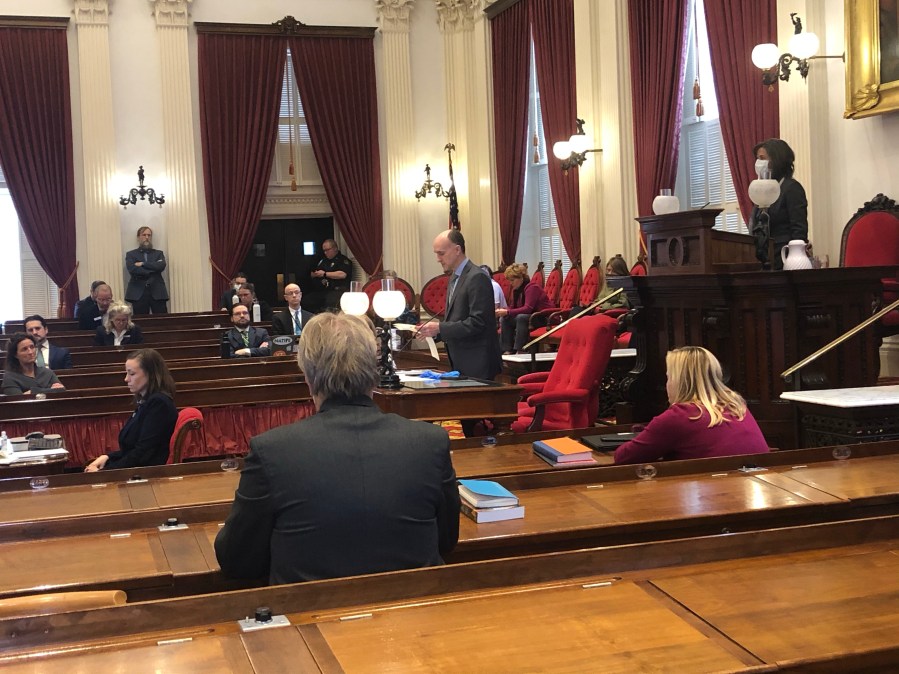

Good evening all – a few notices and invitation to coffee as well as notice that the legislature will be going back into session – virtually – this week. The Senate is a much smaller body of 30, and they have already begun to meet and vote remotely. Meeting virtually with 150 members of the House has required smaller practice sessions on the software used to vote and lots of bumps and questions by legislators. Meeting virtually will be historic, and different, and will have even more glitches. Speaker of the House Mitzi Johnson has been patient, thoughtful and helpful in getting members from all parties – or no party in the independents case – information needed to be able to reconvene. If you have questions, I’d like to hear them. The first vote will be on a resolution allowing us to vote remotely. This weeks sessions can be watched in your home – a rare benefit from COVID!

- All-House Caucus on Wednesday, April 22, 2020 at 3:00 PM. To view the House proceedings, go to the following location: https://legislature.vermont.gov/house/streaming/full-house

- House Session on Thursday, April 23, 2020 at 10:00 AM and 1:00 PM. To view the House proceedings, go to the following location:https://legislature.vermont.gov/house/streaming/full-house

Here is a link that you can use to access a webinar covering municipal essential services under the COVID-19 orders and guidance. The webinar is live on Wednesday (4/22) at 2:00 PM.

The U.S. Senate passed another relief bill this evening, the Paycheck Protection Program and Health Care Act. The Senate deal includes:

- Paycheck Protection Program

- Additional $310 billion in funding (on top of $349 billion in CARES Act)

- $30 billion carve-out for Insured Depository Institutions and Credit Unions with assets between $10 billion and $50 billion in assets

- $30 billion carve-out for Community Financial Institutions, Small Insured Depository Institutions and Credit Unions with less than $10 billion in assets

- Additional $50 billion for SBA Disaster Loan Program

- Emergency Injury Disaster Loan Program

- Additional $10 billion in funding (on top of $10 billion in CARES Act) Expands eligibility to agricultural enterprises with less than 500 employees

- Public Health Funding

- $75 billion for hospitals and health care providers responding to the COVID-19 pandemic (on top of $100 billion in CARES Act)

- $25 billion for testing, including $11 billion for states, localities, territories, tribes and employers

Coffee with Laura call at 7 am Monday, Wednesday and Friday. You can join that call here:

https://us04web.zoom.us/j/734376857?pwd=Z1BmNmlwcWxJMWxVZTFaZE96MmlQQT09

Meeting ID: 734 376 857 Password: 003089 or by calling mobile

+16465588656,,734376857# US (New York)

+13126266799,,734376857# US (Chicago)

Bookmark for updates:

Vermont Department of Health 2019 Novel Coronavirus Current Status in Vermont Webpage for updates.

U.S. Centers for Disease Control Coronavirus Disease page

World Health Organization Coronavirus Disease 2019

Vermont joint Fiscal Office brief: Education Finance Issues Raised by the COVID-19 Pandemic

A message from Grace Cottage

I did not receive the $1,200 economic impact payment

IRS Economic Impact Payments The federal government authorized and appropriated funds to provide Americans economic impact payments of up to $1,200. Information about eligibility and the process can be found here.

While many of those who qualify for the payments have already received them, others may not yet have.

STUDENT LOAN RELIEF SECURED FOR BORROWERS NOT COVERED BY FEDERAL CARES ACT

Governor Phil Scott and Department of Financial Regulation (DFR) Commissioner Michael Pieciak today announced a multi-state initiative to secure student loan relief options for thousands of Vermonters with privately held student loans. The relief, confirmed with several of the most significant national private student loan servicers, will expand on the protections already provided by the Vermont Student Assistance Corporation (VSAC) and provided to federal student loan borrowers under the Coronavirus Aid, Relief, and Economic Security (CARES) Act.

Borrowers in need of assistance, including VSAC borrowers, must immediately contact their student loan servicer or lender to identify the options appropriate to their circumstances. Relief options include:

- Providing forbearance of payments for a minimum of 90 days;

- Waiving any applicable late payment fees;

- Protections from negative credit reporting;

- Ceasing debt-collection lawsuits for 90 days; and

- Working with borrowers to enroll them in appropriate assistance programs, such as income-based repayment.

If student loan servicers are limited in their ability to take these actions due to investor restrictions or contractual obligations, the servicers will proactively work with loan holders to relax those restrictions or obligations whenever possible. DFR examiners will favorably consider prudent and reasonable actions taken to support relief for borrowers during the pandemic.

Students with federal loans were provided relief under the CARES Act, however, the CARES Act provided no relief for federal loans not owned by the federal government or for loans made by private lenders. Under this initiative, many Vermonters with commercially owned Federal Family Education Loan Program loans or privately held student loans who are struggling to make their payments due to the COVID-19 pandemic will be eligible for expanded relief.

To determine the types of federal loans they have and who their servicers are, borrowers can visit the Department of Education’s National Student Loan Data System (NSLDS) at nslds.ed.gov or call the Department of Education’s Federal Student Aid Information Center at 1-800-433-3243 or 1-800-730-8913 (TDD). Borrowers with private student loans can check the contact information on their monthly billing statements. VSAC borrowers may call 1-833-802-8722 for assistance.

If a borrower is experiencing trouble with their student loan servicer, they are encouraged to contact the following and file a complaint:

- DFR Banking Division: call (888) 568-4547 or email dfr.bnkconsumer@vermont.gov.

- Attorney General’s Consumer Assistance Program: call (800) 649-2424 or email AGO.CAP@vermont.gov.

- The Consumer Financial Protection Bureau: www.consumerfinance.gov/complaint/.

Other states joining this initiative include California, Colorado, Connecticut, Illinois, Massachusetts, New Jersey, Virginia and Washington.

In addition to VSAC, which already provides these relief options, the other private student loan servicers providing relief includes: Aspire Resources, Inc., College Ave Student Loan Servicing, LLC, Earnest Operations, Edfinancial, Kentucky Higher Education Student Loan Corporation, Lendkey Technologies, Inc., Missouri Higher Education Loan Authority (MOHELA), Navient, Nelnet, SoFi Lending Corp., Tuition Options United Guaranty Services, Inc., Upstart Network, Inc. and the Utah Higher Education Assistance Authority

Governor Scott Press Release:

In addition to an update on COVID-19 in Vermont, Governor Scott will provide an update on the state’s efforts to clear claim issues that are holding up Unemployment Insurance benefits to Vermonters.

Following remarks, the Governor and administration officials will be available for questions from members of the media.

Wednesday, April 22 at 11:00 a.m.

GENERAL PUBLIC VIEWING:Most Vermont TV and radio stations live broadcast the briefings. The Governor’s media briefing will be available to stream through ORCA Media’s youtube channel, linked here: https://www.youtube.com/playlist?list=PL-xsDpLCa0iRMj4dQrqum7uoXaQmqeGvT

Please do not hesitate to contact me with questions, or if you need assistance navigating government services at (802) 384-0233 or lsibilia@leg.state.vt.us

Kind regards,

Rep. Laura Sibilia

Dover, Readsboro, Searsburg, Somerset, Stamford, Wardsboro, Whitingham